Why Hard Money Georgia Is the very best Choice for Fast Real Estate Financing

Why Hard Money Georgia Is the very best Choice for Fast Real Estate Financing

Blog Article

The Advantages of Selecting a Tough Cash Lending Over Standard Financing Choices

In the realm of property financing, tough money car loans present a compelling option to conventional choices, especially for capitalists looking for swift access to funding. Significantly, these loans help with quicker approval procedures and take on a much more lax strategy to borrower credentials, emphasizing building value over credit background. This one-of-a-kind structure not only lessens bureaucratic obstacles however also placements investors to profit from time-sensitive opportunities in open markets. The effects of such financing prolong past speed and simplicity, increasing questions concerning long-lasting viability and critical placement with financial investment goals. What factors to consider should one remember?

Faster Access to Resources

Securing financing quickly is a critical benefit of tough cash lendings. Unlike typical financing options, which often involve extensive approval processes and comprehensive paperwork, tough money finances offer expedited access to funding. This is specifically useful genuine estate investors and developers that call for immediate funding to take possibilities in an affordable market.

Commonly, difficult money lending institutions concentrate on the worth of the home being financed instead of the borrower's credit reliability. Because of this, these lendings can be approved in an issue of days as opposed to months or weeks. The streamlined procedure allows consumers to relocate swiftly on building acquisitions, restorations, or various other immediate financial needs.

Additionally, tough money car loans are commonly structured to suit various task timelines, allowing consumers to get funds when they need them most. This rate is necessary in property purchases, where market conditions can alter quickly, and the ability to act promptly can indicate the distinction in between safeguarding a profitable bargain or shedding it to one more purchaser.

Versatile Qualification Requirements

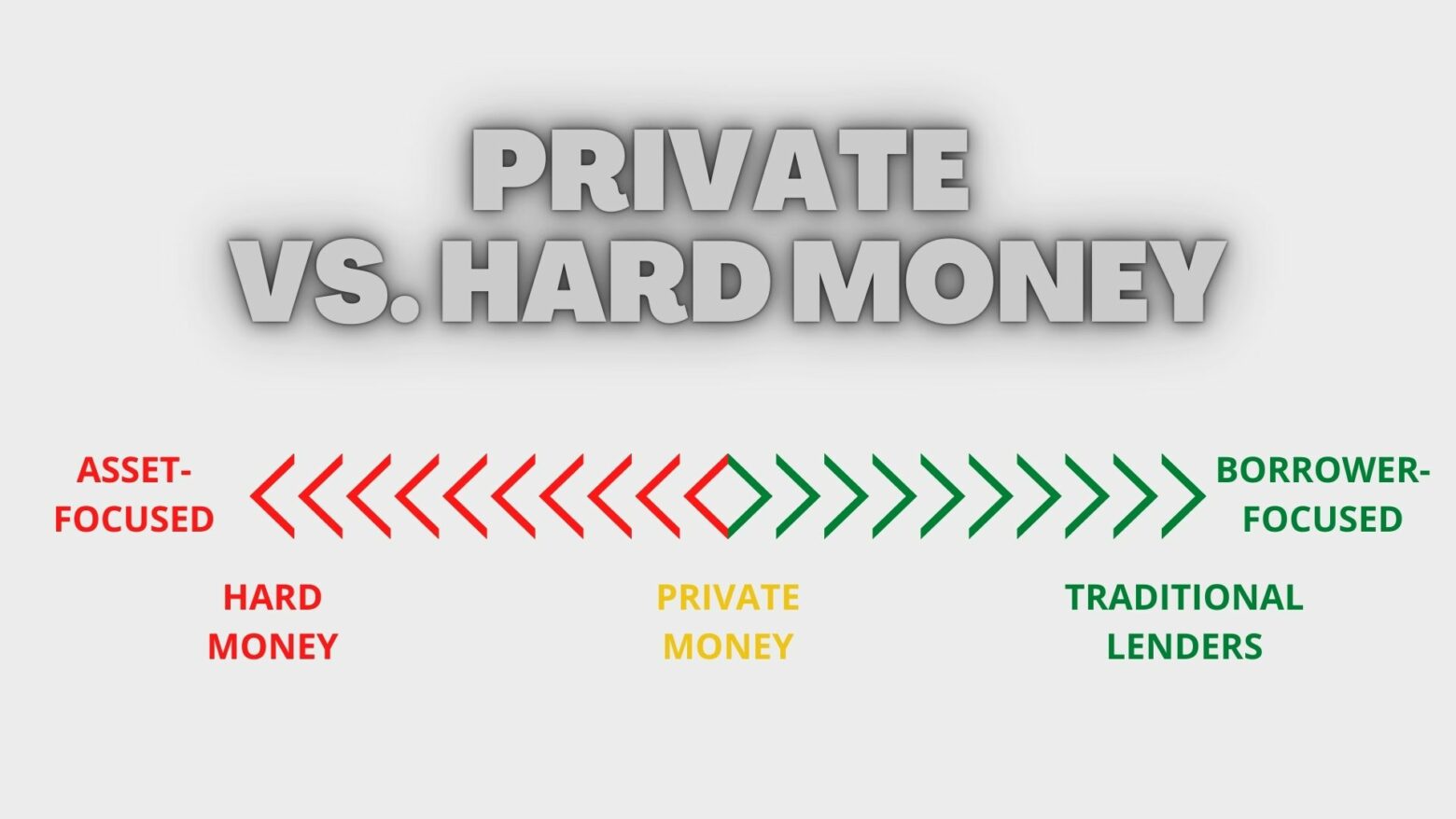

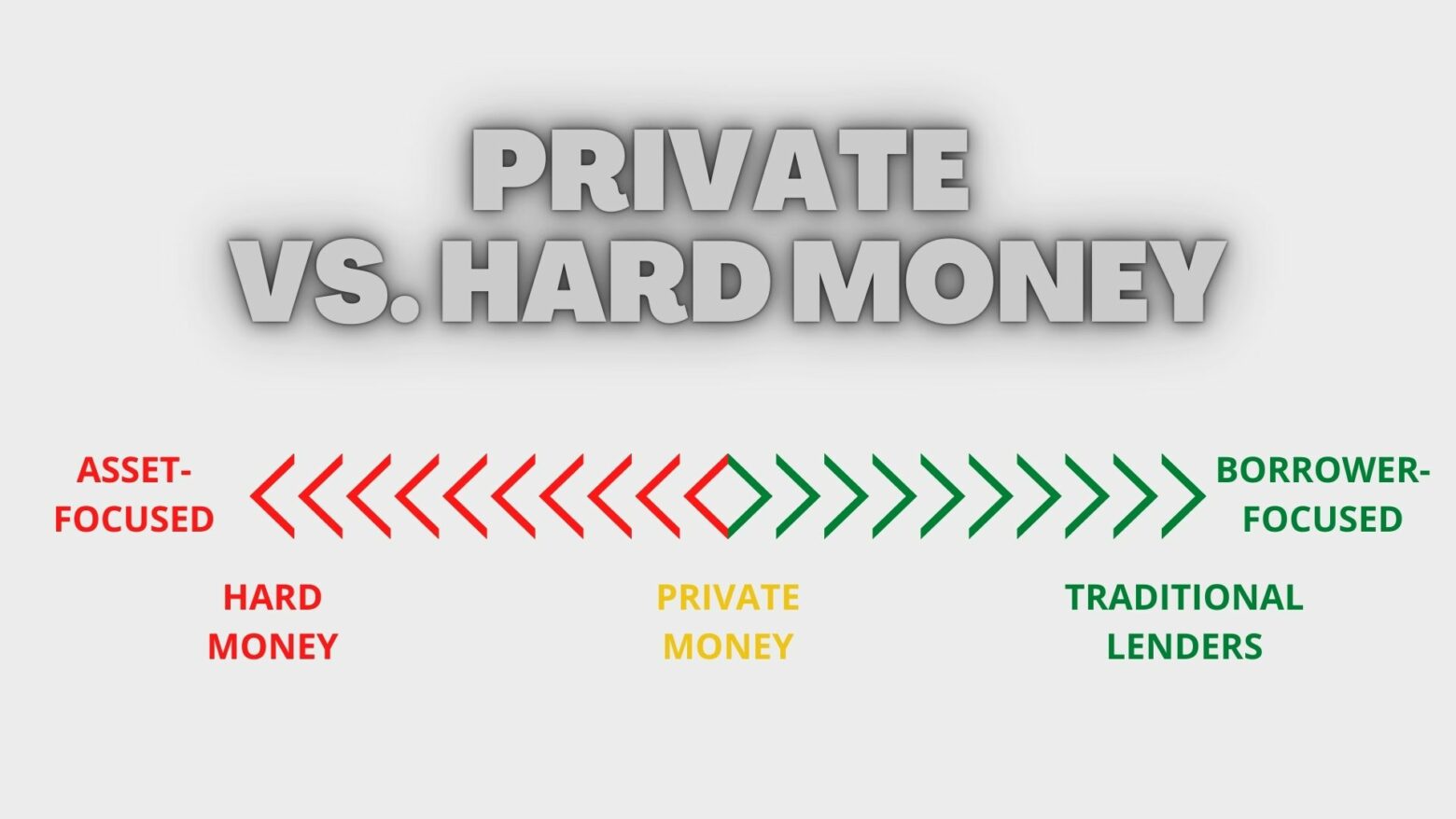

Tough cash finances are identified by their flexible certification requirements, making them an eye-catching option for a varied array of customers. Unlike conventional funding, which commonly calls for strict credit rating checks and considerable paperwork, tough money lenders focus mostly on the worth of the security, typically actual estate. This indicates that customers with less-than-perfect credit score ratings or restricted financial background can still safeguard financing, as the possession itself functions as the primary assurance for the loan.

This adaptability opens doors for various people, including real estate capitalists, business owners, and those in immediate need of funding. Borrowers encountering economic obstacles, such as current insolvencies or foreclosures, might discover tough money fundings to be a practical service when conventional lenders reject to prolong credit rating. The standards can vary substantially amongst various loan providers, enabling consumers to work out terms that finest fit their certain situations.

Inevitably, the adaptable nature of certification standards in difficult cash offering not only helps with quicker access to funds yet likewise encourages debtors to take benefit of possibilities that might or else run out reach. This element emphasizes the appeal of difficult cash financings in today's dynamic economic landscape.

Much Shorter Financing Approval Times

Among the significant advantages of tough cash fundings is their significantly shorter authorization times contrasted to traditional financing techniques. While standard loan providers may take weeks or also months to refine a loan application, difficult money loan providers commonly expedite their authorization process - hard money georgia. This effectiveness is especially valuable genuine estate financiers and property customers who need instant access to funds

The rapid approval timeline is largely due to the fact that hard money car loans focus largely on the worth of the security as opposed to the debtor's credit reliability. This allows lenders to make fast assessments based upon home evaluations, therefore removing lengthy underwriting procedures common in traditional financing. Because of this, debtors can typically get financing within a matter of go to this website days, enabling them to act quickly in competitive realty markets.

This speed is critical for financiers seeking to confiscate time-sensitive chances, you can look here such as distressed buildings or auctions, where delays could imply losing an offer. By picking a hard cash lending, customers can browse the market extra effectively, permitting them to protect residential properties prior to others have the possibility to act. The fast access to funding can be a game-changer for those in need of a timely financial remedy.

Less Documentation and Documents

The streamlined authorization procedure of difficult cash loans is matched by a substantial reduction in documentation and documents requirements. Unlike conventional financing, which often demands considerable documentation such as revenue confirmation, credit report, and detailed monetary declarations, difficult money finances focus on simplicity and performance. This decrease in paperwork enables debtors to concentrate on safeguarding financing rather than browsing with a maze of approvals and types.

Difficult money lenders generally place even more focus on the value of the security instead of the borrower's economic background. Consequently, the paperwork required often consists of only the residential or commercial property evaluation, evidence of ownership, and some standard recognition. This change not only accelerates the approval process but likewise minimizes the anxiety connected with celebration extensive documentation.

Additionally, the marginal documents entailed makes difficult link money lendings especially appealing genuine estate financiers and developers who may need to act promptly on financially rewarding opportunities (hard money georgia). By removing the concern of extreme paperwork, tough cash lendings enable customers to secure funding with better agility, enabling them to focus on their financial investment objectives as opposed to obtaining bogged down in management obstacles. This streamlined approach significantly improves the borrowing experience

Investment Opportunities With Much Less Competitors

Financial investment opportunities in realty often manifest in environments where competitors is restricted, permitting savvy capitalists to take advantage of on special deals. Tough money car loans offer a strategic benefit in such situations. Unlike conventional financing, which can be stalled by strict needs and lengthy authorizations, hard money fundings offer fast accessibility to funding, allowing investors to act promptly.

In markets identified by less competition, residential or commercial properties might be underestimated or forgotten by standard purchasers. This offers an opportunity for financiers to protect lower purchase rates and improve their returns. With tough money finances, investors can rapidly obtain these residential or commercial properties, apply essential improvements, and subsequently boost their market value.

In addition, the flexibility of difficult cash lending permits innovative funding services that conventional loan providers might not captivate, even more lowering competitors for preferable possessions. Investors can leverage their experience and market understanding, positioning themselves to seize opportunities that others could miss out on. Eventually, the agility and responsiveness managed by difficult money car loans encourage capitalists to browse less affordable landscapes properly, turning possible risks right into lucrative benefits.

Conclusion

In conclusion, difficult cash financings existing considerable benefits over typical funding alternatives, particularly in terms of expedited accessibility to resources and more flexible credentials standards. Thus, tough money financings serve as a useful monetary device for financiers looking for accessible and fast financing options.

Hard cash financings are identified by their versatile certification criteria, making them an appealing choice for a diverse array of debtors. Consumers facing economic challenges, such as current personal bankruptcies or foreclosures, may locate hard cash loans to be a sensible service when traditional lending institutions reject to expand credit rating.The rapid authorization timeline is mainly due to the truth that tough cash financings focus mostly on the worth of the collateral instead than the debtor's creditworthiness. By choosing a hard cash loan, customers can navigate the market extra effectively, allowing them to protect buildings before others have the opportunity to act. By eliminating the burden of too much paperwork, hard money loans allow customers to safeguard financing with better agility, enabling them to focus on their financial investment objectives rather than getting bogged down in management hurdles.

Report this page